Digital Banking - Bill Pay

NCR | 2021

Led UX design and research for a bill pay redesign that our Financial Institution customers and partners could use as a white-labeled solution.

Project Overview

Title: Digital Banking - Bill Pay

My Role: UX Lead/Manager

Team: Product Managers, Dev/Engineering Team, Jr. Designers & Researchers

Duration: 6 months

Impact: Conducted initial rounds of research and created an initial redesigned Bill Pay experience for our Financial Institution customers and partners

Context & Problem Definiton

Background: Bill Pay usage is declining ~10% annually, creating a retention risk for financial institutions. As a “sticky” feature tied to customers’ core finances, its decline weakens engagement and loyalty.

Target Users: Financial institutions - banks and credit unions

Problem Statement: How might we create a redesigned Bill Pay experience that reverses declining usage, strengthens customer retention, and helps financial institutions (FIs) - that use our white-labeled product - stay competitive against emerging digital-first banks?

Constraints: Creating an experience that met the differing needs of several banks and credit unions

Research & Discovery

Methods: Competitive Analysis, Literature Review, SME Workshops, Interviews

Key Insights: Using Bill Pay isn’t as easy and intuitive as customers need

Impact on Direction: Allowed me to pick an area to focus on for the redesign

Built a UX strategy around answering the following:

How can a redesigned Bill Pay experience help Financial Institutions engage and retain customers?

How can we modernize and simplify the Bill Pay experience so more customers can easily engage with it?

To address the ambiguity of the Bill Pay redesign, I applied a layered research strategy—competitive analysis, literature review, SME workshops, and information architecture benchmarking.

This approach framed the problem space broadly, validated it against industry trends, and grounded the design direction in both customer and institutional perspectives.

The result was a clear, evidence-based UX strategy that defined the core requirements for a modern Bill Pay experience and aligned stakeholders around a shared vision, ensuring design decisions were customer-centered and positioned to strengthen retention and engagement for financial institutions.

Competitive Analysis

I began with a competitive analysis across credit unions, large banks, and online-only providers. Despite their differences, most bill pay experiences looked the same. None offered true innovation.

View the complete competitive analysis here.

I organized the competitive analysis into the following focus areas so I could properly evaluate key features across the 10 competitors and their web and mobile experiences:

Access to Bill Pay feature from home screen

Bill Pay home screens

Calls to Action (CTAs)

Sending money to a recipient

Selecting the date to pay the bill

Paying the bill

eBill feature

Information Architecture Benchmarking

By analyzing how competitors structured their Bill Pay homepages, I identified three “table stakes” features: quick-add recipients, upcoming payments, and recent transactions. These findings directly shaped the redesign’s core information architecture and interaction patterns.

Literature Review

I reviewed industry research on emerging digital banking trends to align the redesign with evolving customer expectations. This ensured the solution not only addressed current needs but remained competitive and future-ready.

Technology Trends

What technologies are customers interacting with on a daily basis?

Is there room for Bill Pay to be integrated into any of these?

Business Trends

What are the trends our FI customers are following in order to compete and gain market share?

Customer Trends

What are customers currently doing in terms of paying bills, sending money, money management, etc?

How does Bill Pay fit into all of this?

Socioeconomic Trends

What broader cultural forces are impacting our customers?

What factors relating to race, income level, etc. make Bill Pay less accessible to certain groups of people?

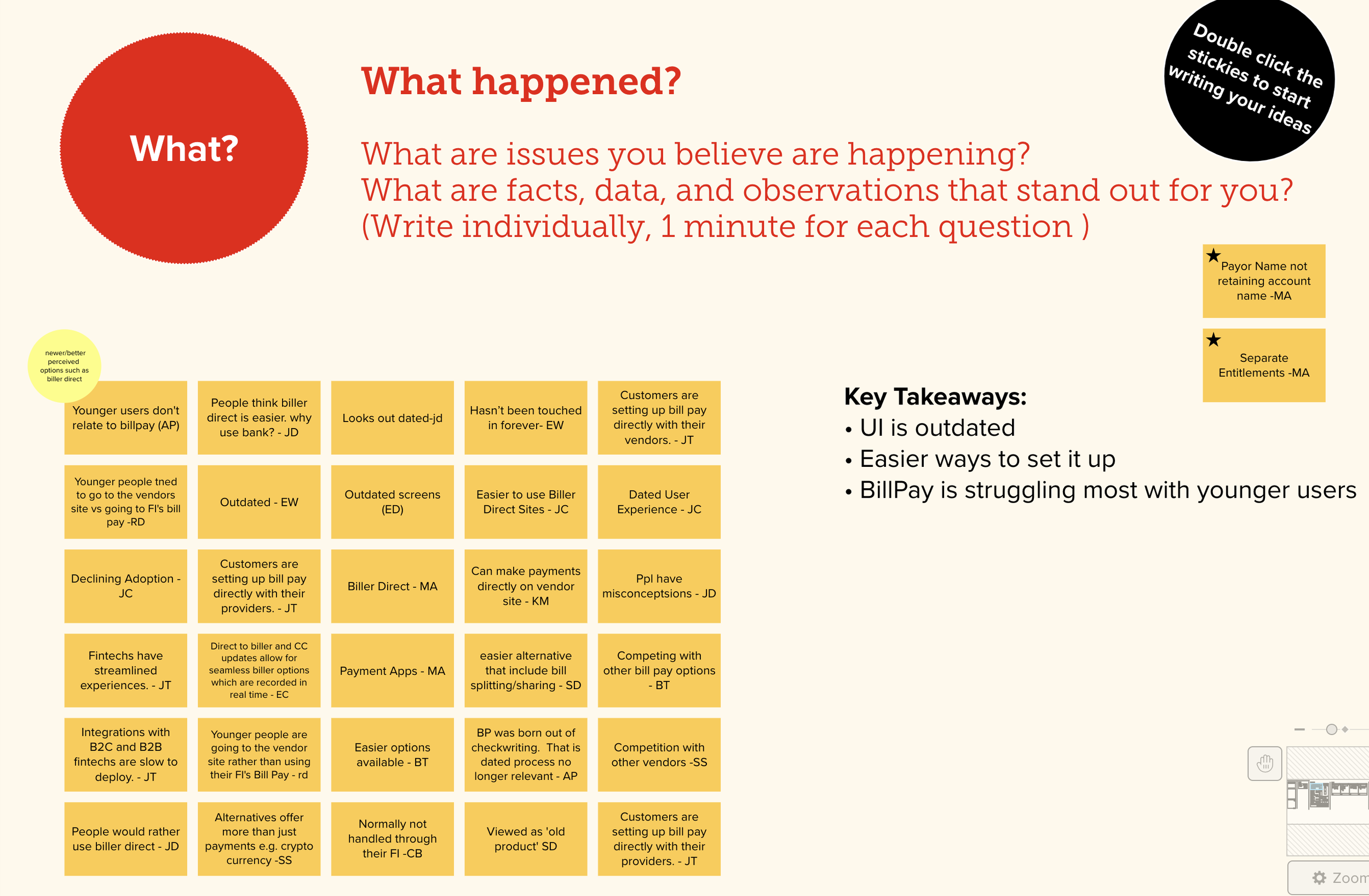

SME Workshops

I facilitated four workshops with 21 participants across product, design, training, and FI support teams. These sessions surfaced first-hand insights into customer pain points and internal challenges, grounding the redesign in diverse, practical perspectives.

Admin SMES

Perspective on what information admins control in the backend

Business SMES

Worked with them to discuss changes in the consumer app that might later affect the rollout

Consumer SMES

Worked with them to understand immediate needs

FI Representatives

Understanding the issues they’ve had over the years and why

FI Interviews

Building on the SME workshops and NCR’s internal perspective, I conducted interviews with eight financial institutions to gather direct input. These conversations focused on understanding what their end-user customers were saying about current Bill Pay experiences. My interview guide explored four key categories:

The sign-up experience

Date selection for sending payments

Online bills (eBills)

Account balances

These interviews validated key problem areas, revealed gaps not captured in earlier research, and ensured that the Bill Pay redesign was shaped by both customer pain points and the operational realities of financial institutions.

Themes & Design Process

Following the research cycle, I synthesized insights into five key themes and translated them into actionable user stories to guide design and development.

*User stories that got incorporated into my proposed design are highlighted

Customers expect a modernized Bill Pay experience

As a user, I want an experience that reflects how I already manage money in my daily life, so it feels intuitive and easy to adopt.

As a user, I want tools to organize and manage my payments, so I feel confident and in control of my finances.

As a user, I want a responsive interface, so I can seamlessly access and use the experience on any mobile device.

As a user, I want a personalized experience that adapts to my financial situation and habits, so the service feels relevant and supportive.

Customers choose Bill Pay only if it’s simpler than paying billers directly

As a user, I want a conversational setup experience that guides me step by step, so I feel supported and confident from the start.

As a user, I want the setup process to be as quick and simple as biller direct, so I can begin using Bill Pay with my financial institution without unnecessary effort.

Customers want an intuitive experience that educates them

As a user, I want a clear and consistent Bill Pay experience that provides transparency, so I can both learn from it and build trust with my financial institution.

Current Bill Pay lacks financial wellness features

As a user, I want clarity on which bills are most important so I can effectively prioritize my payments.

As a user, I want tools to help me track my payments and understand my account balance.

Customers are concerned about their sent payments not arriving on time

As a user, I want clear guidance on how and when to send payments so I can be confident they will arrive on time.

Final Solution

With a clear strategy in place, the next step was translating research insights into actionable design. I began by mapping user journeys and pain points to frame opportunities, then developed concept sketches and wireframes that reflected both customer needs and institutional requirements. Each design artifact was created to build alignment — first as lightweight explorations to spark discussion, then as high-fidelity prototypes to demonstrate how the redesigned Bill Pay experience could function end-to-end.