Fintech Envisioning

FIRST DATA INNOVATION LAB | 2016-2017

This exploratory project aims to understand what consumers consider “necessity spending” when it comes to their financial habits.

Project Overview

Title: Fintech Envisioning (Necessity Spending)

My Role: UX (Design & Research) Lead

Team: Product Manager

Duration: 4 months

Impact: Advised leadership on technology and product opportunities through market gap analysis and storyboards, while providing thought leadership on consumer behavior across multi-device shopping journeys

Context & Problem Definiton

Background: We hypothesize that people view routine necessity spending as obligatory, so they overlook pain points in these shopping experiences despite room for improvement.

Target Users: Everyday consumers and shoppers

Problem Statement: How do people define necessities, and how can we improve how they shop for them?

Constraints: Finding a variety of local consumers to interview

Research & Discovery

Methods: Survey, Literature Review, & In-Person Interviews

Key Insights: Most people define their “necessity spending” as shopping related to food

Impact on Direction: Allowed me to pick a theme for concepts to explore

Phase 1: Survey to understand the current space

I created a survey and gathered 50+ responses from friends, family, and acquaintances to inform our research

Phase 2: Literature Review

To explore tech use in shopping habits and survey trends, I reviewed 25 articles

Phase 3: In-person Interviews

I created a screener and partnered with a recruiting agency to conduct in-home interviews across diverse demographics. Discussing money in a familiar setting encouraged openness, while my product manager captured notes

Ideation & Design Process

After defining categories and technologies, I refined storyboards with my team for clarity and tested final versions in 10 in-person interviews.

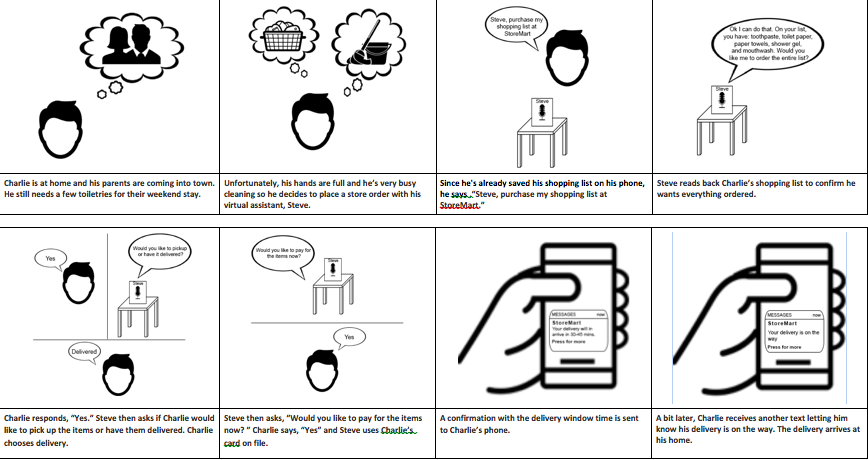

Shopping With a Virtual Assistant

Insight: Grocery delivery is convenient and customers are willing to pay a premium for it.

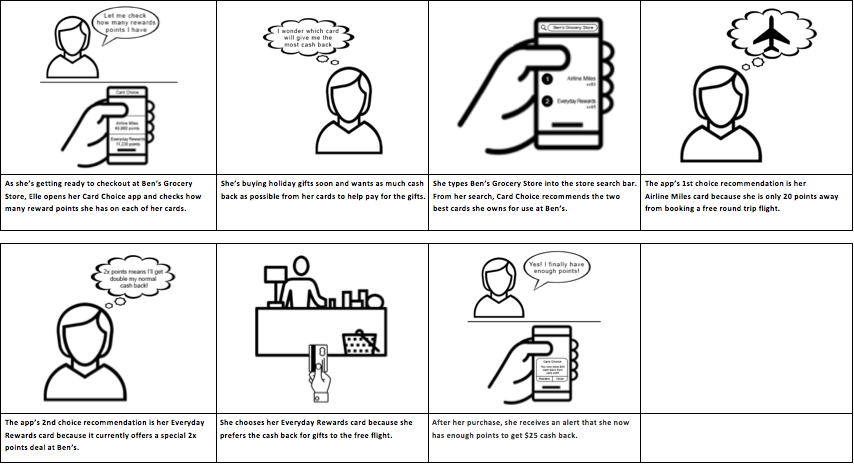

Choosing the “Best” Card For Purchases

Insight: Customers often choose credit cards based on limits, interest rates, or account history—rather than simply maximizing reward points.

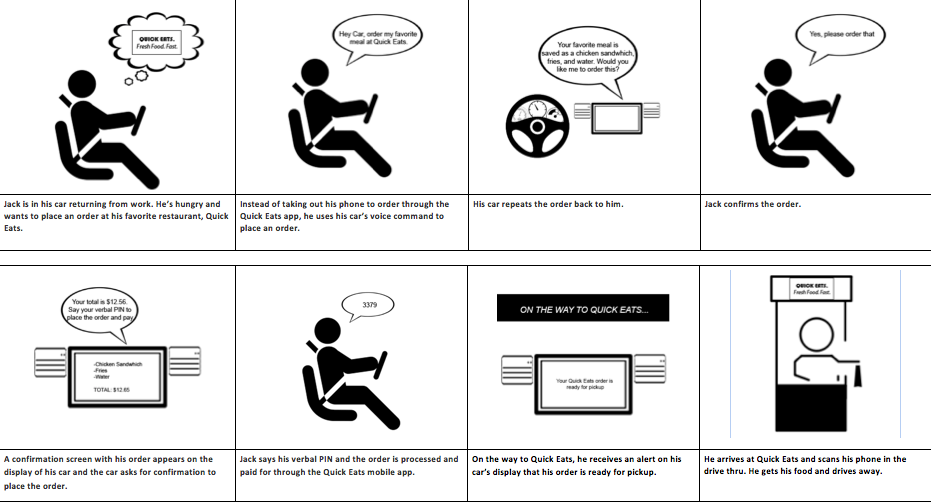

Hands Free Ordering in Your Car

Insight: Customers see mobile ordering as convenient for on-the-go use, but question whether it’s truly faster than a drive-thru.

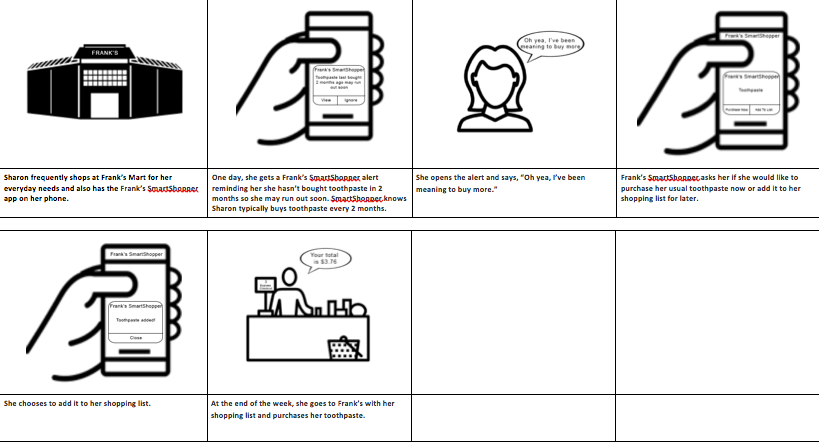

Reordering Items

Insight: Customers struggle to remember essential items, since stocking up often leaves them unprepared when supplies unexpectedly run out.

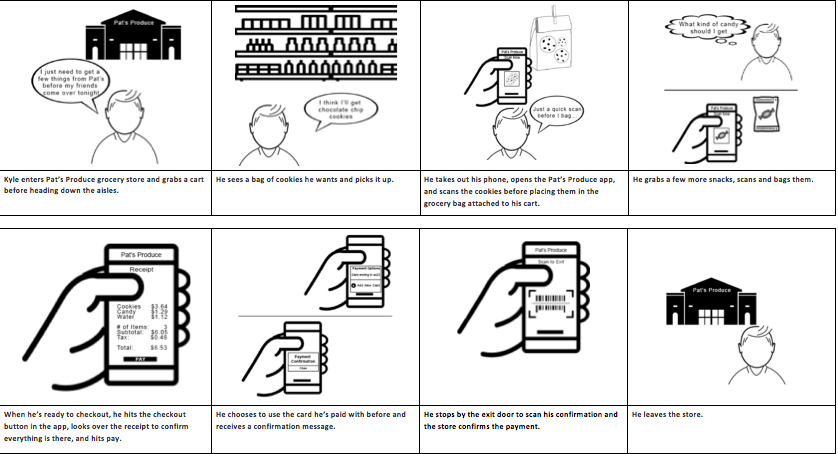

Self Scan at Grocery Store

Insight: Customers value self-checkout for the control it gives them, but lines often move slower since shoppers can’t bag as quickly as clerks.

Rerouting to a Nearby Store

Insight: Customers find voice-activated GPS valuable for rerouting on the go without texting and driving.

Conclusion

We found food to be the largest necessity expense beyond recurring bills. If taken beyond prototyping, we’d focus on solutions for fast food, grocery, and restaurant purchases.

During the interviews, we asked participants to rank each storyboard concept by most to least beneficial to their current necessity spending.

Self Scan at Grocery Store

Choosing the “Best” Card for Purchases

Rerouting to a Nearby Store

Shopping With a Virtual Assistant

Reordering Items

Hands Free Food Ordering in Your Car

We successfully met our goal of updating thought leadership on trends in this space, but if extended beyond prototyping, we’d explore solutions to drive commerce in fast food, grocery, and restaurant purchases.

Months after testing our “Self Scan at Grocery Store” concept, Amazon announced Amazon Go —a nearly identical cashier-less model—validating our research and user insights.